Volopa news

We've given our mobile app a facelift, download today to see what's in store

New design, better interface

We are excited to announce the release of our newly designed business app. The new app has been relaunched with a cleaner look and an even better interface giving cardholders oversight on their spending.

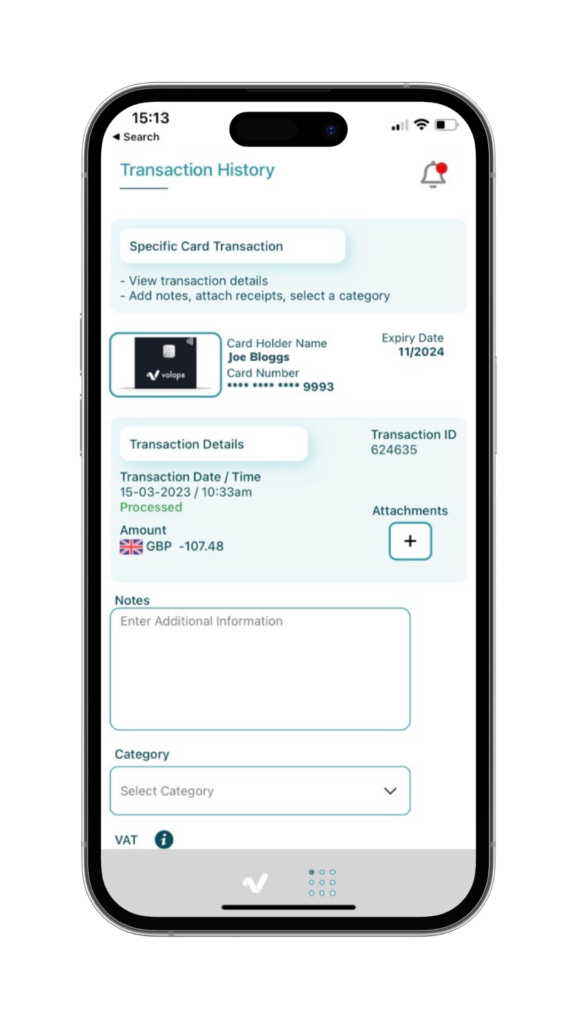

Complete with a new interface for a more enjoyable user experience with the Volopa Business cards, the app allows users to do more on the go with improved navigation, transaction viewing and editing functionality, making it easier for admins and finance teams to stay in control of their company expenses.

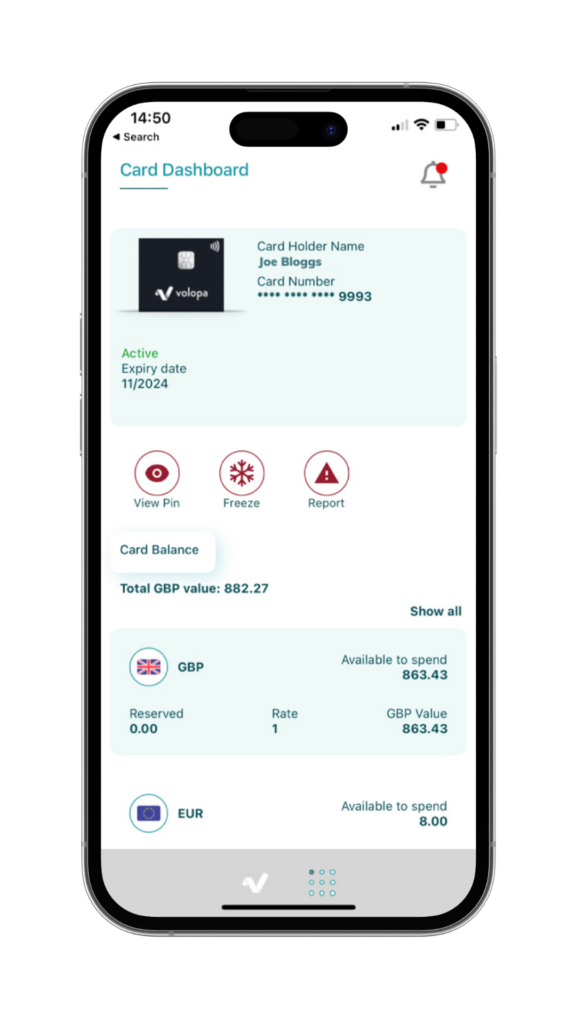

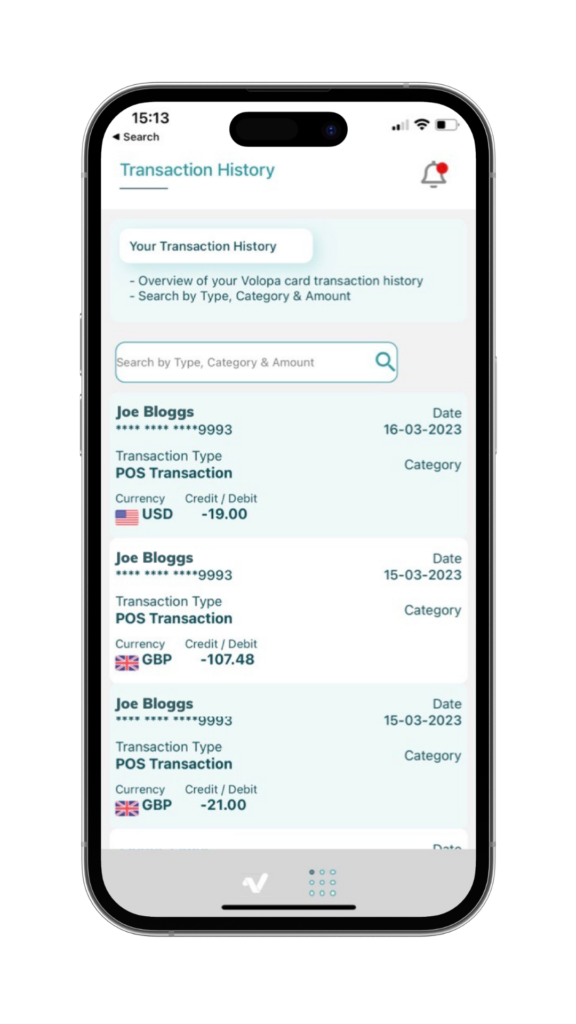

Cardholders can manage their business prepaid cards using their individual accounts, get oversight on all pending and active transactions and make notes, attach receipts and calculate VAT for each specific transaction, making end-of-month reconciliation a breeze.

Everything you need to manage your spending on the go

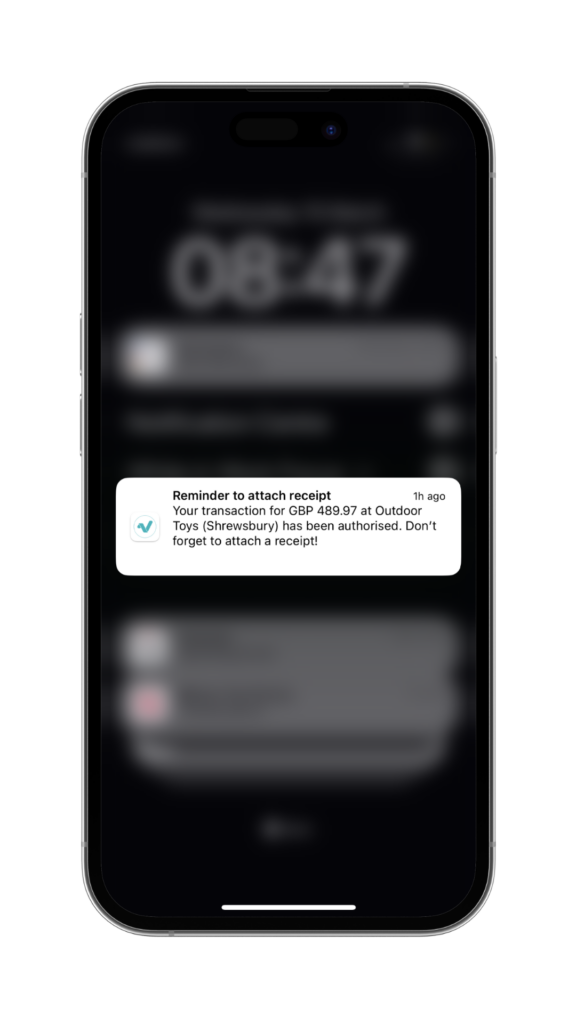

Get instant notifications of your transaction and reminders to capture your receipt in the app

Get oversight on all your active and pending transactions

Categorise specific transactions, add receipts, notes and calculate VAT

Freeze and unfreeze your card if you misplace it

How it works

Make life easier for your finance team. Simply log in to your account and click on a transaction. Attach the relevant notes and categorise using the fields available, take a photo of your receipt and attach it for ease, saving time and reducing the risk of losing important receipts.

It’s slick, but we’re not done yet, over the next couple of months we will be releasing new updates and exciting features to provide you with even greater control over your team spending. Keep an eye out on our blog for more announcements soon.

If you are an existing user, you can log in with your existing account details and all your historic information will be visible in the new app.

We are on a mission to continue building the right tools to enhance your daily tasks so you can focus on the work that counts. Join our community of businesses that are switching to our smarter payment solution.

Follow our journey on social media.

Find out more about what Volopa can do for you

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.

Securing the best exchange rates

Generally speaking, both banks and payments providers charge a margin, typically via a commission or a percentage-spread, for converting currencies from the funding currency (what you send them) to the payment currency (what the recipient receives). Banks are traditionally risk averse to currency movements due to the size of the portfolio of client assets they hold in multiple currencies. Any shock movement within the currency market can amount to significant losses, and in a bid to mitigate this risk, banks tend to apply higher margins.

International payments providers generally take a different approach, utilising live rates which they transact with immediately. Using this methodology, they don’t need to hold on to funds, the risk is less, and margins can therefore be much lower amounting to better exchange rates for their clients.

Payment Speed

Just as a bank cheque takes time to deposit into an account, so does sending money from one country to another. International FX payments can often take days to reach your recipient if sent via your bank. This is because banks often use manual currency conversion processes and tend to send funds via costly legacy banking networks. If you wish to transfer funds quickly, banks may not be your best option.

Specialist payments providers have established “points-of-difference” in the international payments market through innovative solutions to enable same-day international payments using more robust platforms and security systems. Specialist payment providers tend to route international payments via newer alternative payment rails that are quick, low-cost and easy to track, meaning recipients receive their payments in full and on time, while payment initiators can stay up to date with their payment statuses.

Conclusion

Whilst a bank may provide familiarity, specialised payments providers can offer better FX and payments expertise, superior technology and more cost-effective exchange rates. Through the tailoring of solutions and streamlining compliance requirements, services provided are largely more client-centric and focused. This often amounts to lower fees and charges as well as a superior customer experience for their clients.